If you’re thinking about selling your home in 2025, there’s no time like the present to start preparing. I know, it feels like you’ve got plenty of time, but getting a jump on those updates and repairs will save you from scrambling later. Danielle Hale, Chief Economist at Realtor.com, put it best when she said:

“ . . . now is the time to start thinking about what you need for your next home and then taking those steps to prepare to list . . . We have survey data that says 47 percent of sellers are taking longer than a month to get their home ready to sell, so getting them to start that process early can mean more flexibility.”

The earlier you get started, the better. It gives you the wiggle room to tackle any necessary projects at a steady pace rather than rushing through them. But before you roll up your sleeves, partner with an expert agent (like me!) who knows your local market and can give you the inside scoop on which repairs or updates will give you the biggest bang for your buck.

Why Start Early?

To sell quickly and for the best price, your home needs to look its absolute best. That might mean tackling repairs, clearing out clutter, or maybe even making a few upgrades that add real value.

Starting early lets you handle everything one step at a time. Whether it’s fixing that door that’s always been a little sticky, giving the yard some love, or finally painting that room, starting now keeps you in control and stress-free. If you push it all off until later, you’ll probably feel like the list of things to do is never-ending. And, as Realtor.com points out:

“There are some important repairs to make before selling a house, so don’t be in too much of a hurry to get your home listed … if you move too fast, buyers see right through the fact that you skipped important home renovations. And this . . . might end up costing you time and money.”

So, What Should You Focus On?

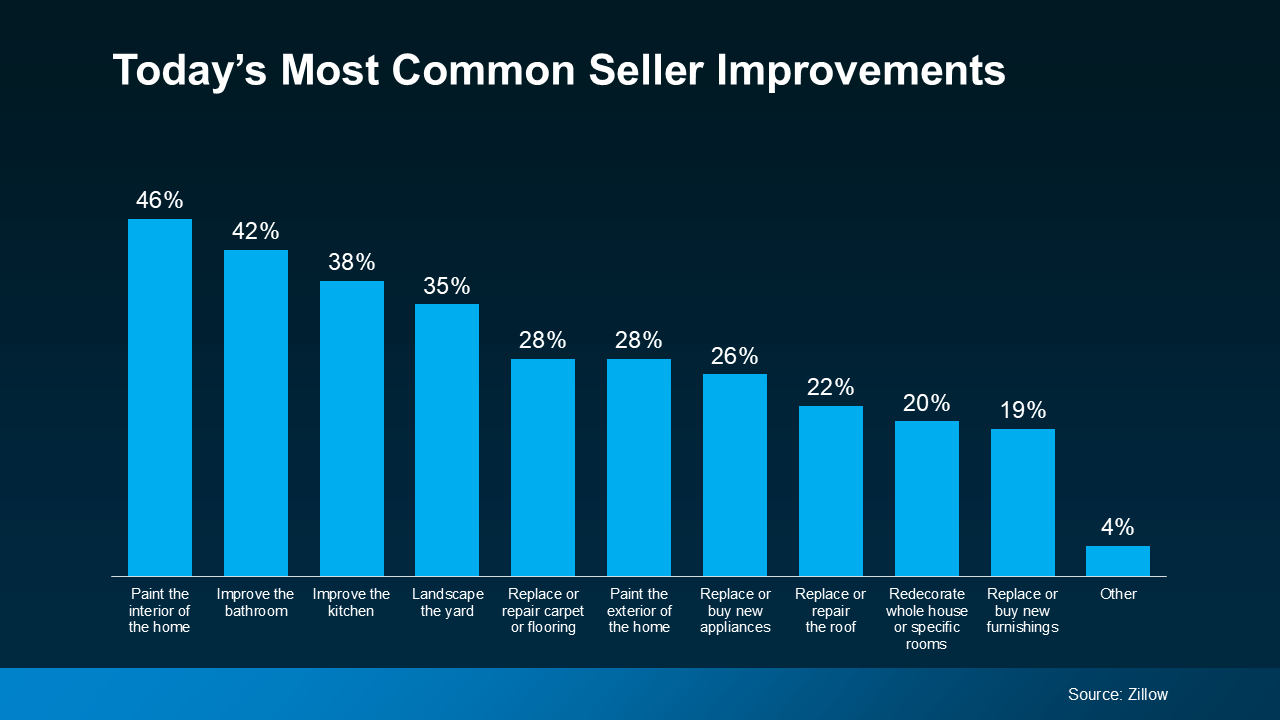

If you’re pumped to get started but feeling a little lost about where to begin, don’t worry—you’re not alone. Take a peek at the chart below for the most common improvements sellers are making today:

Paint the interior of the home (46%) Improve the bathroom (42%) Improve the kitchen (38%) Landscape the yard (35%)

These are some great places to start, but your local market might have its own unique trends. This is where working with an agent who knows the local market becomes key.

The Importance of a Local Expert

While these numbers give you a general idea of what’s popular, they’re just a starting point. What buyers in your area want may be completely different, and only a local agent can help you figure that out.

For instance, if homes in your neighborhood are flying off the market because of updated kitchens, I’d probably suggest you prioritize kitchen improvements over other areas that might not yield as much return. I can also guide you on whether big projects, like a new roof or HVAC upgrade, are worth your time and money based on the competition in your area. As Point puts it:

“Not all renovations are created equal, and focusing on upgrades that offer the highest potential for increasing your home’s value is key.”

And it’s not just the big stuff that counts. Sometimes, smaller details—like sprucing up the yard, adding fresh mulch, or painting your front door—can make all the difference in how buyers see your home. An experienced agent will help you focus on the right projects to make sure your home shines.

Bottom Line

Thinking about selling next year? Don’t wait until the last minute to start getting your house in tip-top shape. By planning ahead, you can have everything ready to go when the time comes.

Not sure where to start? Let’s connect, and I can create a plan tailored just for you.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link