What Lower Mortgage Rates Mean for Your Purchasing Power

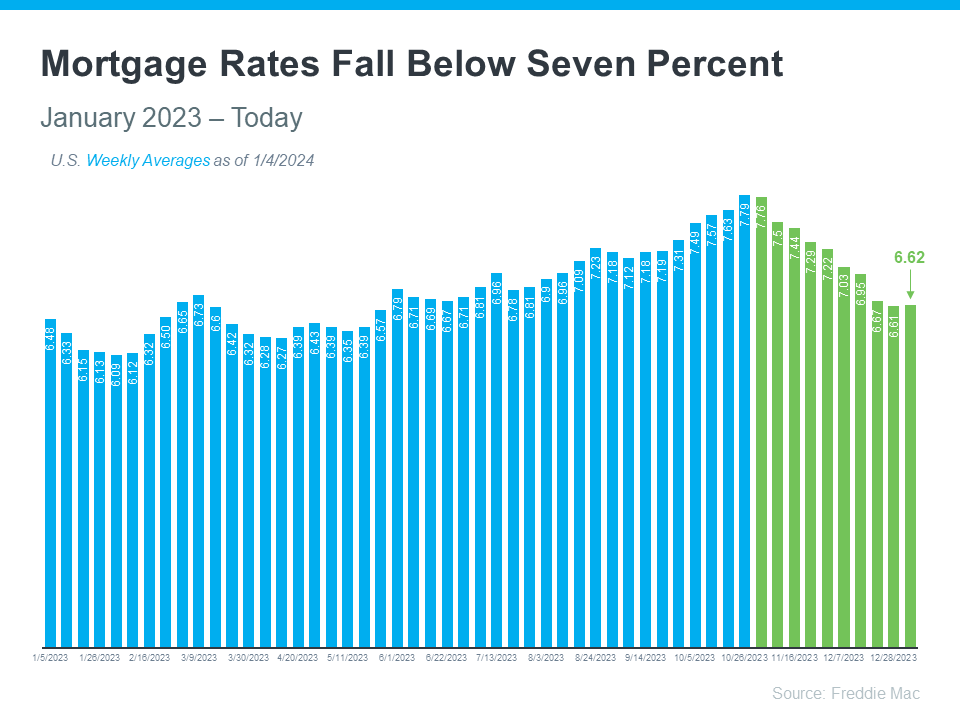

Understanding the pivotal role mortgage rates play in determining affordability and monthly payments is crucial for prospective homebuyers. Fortunately, 30-year fixed mortgage rates have significantly decreased since the end of October, currently standing at less than 7%, as reported by Freddie Mac (refer to the graph below). This positive development is particularly beneficial for buyers, as highlighted in a recent Bankrate article:

“The rate cool-off somewhat eases the housing affordability squeeze.”

Edward Seiler, AVP of Housing Economics and Executive Director of the Research Institute for Housing America at the Mortgage Bankers Association (MBA), affirms:

“MBA expects that affordability conditions will continue to improve as mortgage rates decline…”

This favorable trend can significantly impact your plans to purchase a home.

How Mortgage Rates Affect Your Search for a Home

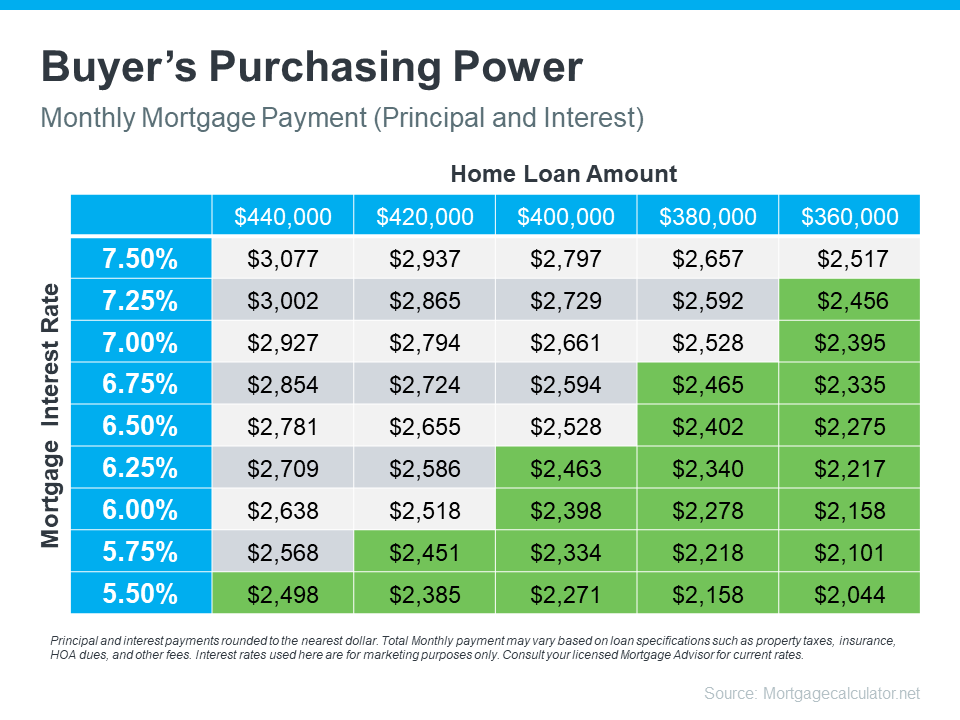

Understanding the Impact of Mortgage Rates on Your Home Search Comprehending the correlation between mortgage rates and your monthly home payment is essential in realizing your dream of homeownership. The chart below illustrates how changes in mortgage rates can alter your ability to afford a home. Imagine having a budget allowing for a monthly payment between $2,400 and $2,500. The green section in the chart represents payments within or below that range (see chart below):

As depicted, even minor fluctuations in rates can influence your budget and the loan amount within your means.

Seek Guidance from Trusted Experts to Navigate Your Budget and Plan Ahead When embarking on the journey to buy a home, seek guidance from a local real estate agent and a reputable lender. They can assist you in exploring various mortgage options, understanding the factors influencing mortgage rate fluctuations, and how these changes impact your financial situation.

By analyzing the numbers and the latest data collaboratively, and adjusting your strategy based on current rates, you’ll be well-equipped and poised to make your home purchase.

Bottom Line: For those aspiring to buy a home, the recent decline in mortgage rates is a positive development for your plans. Let’s connect and strategize for your next steps in the homebuying process.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link