Why You Should Consider Condos as Part of Your Home Search

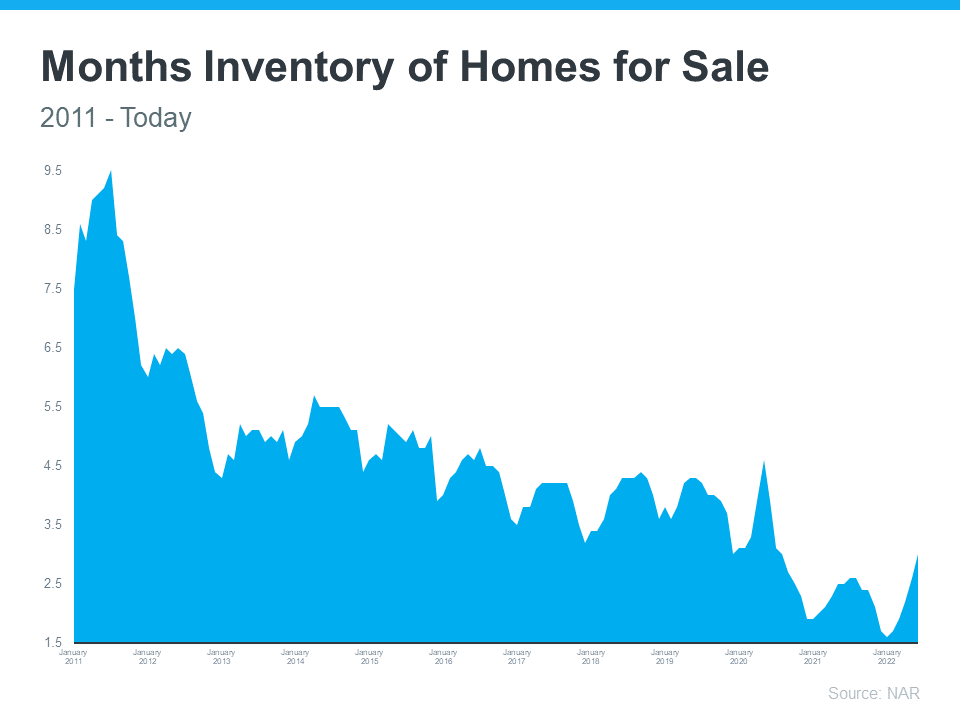

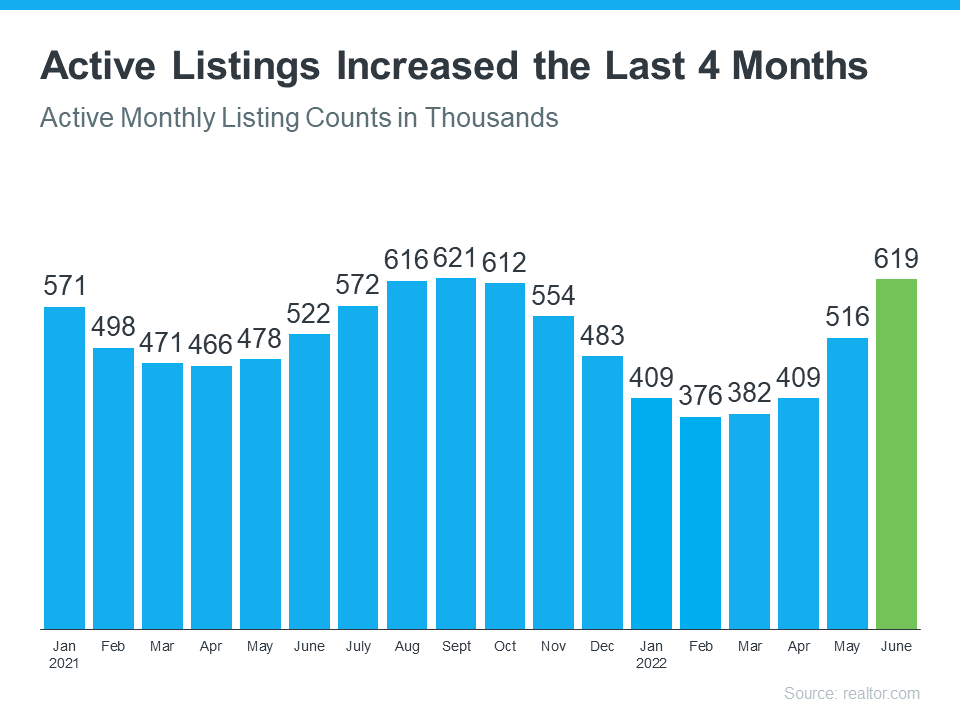

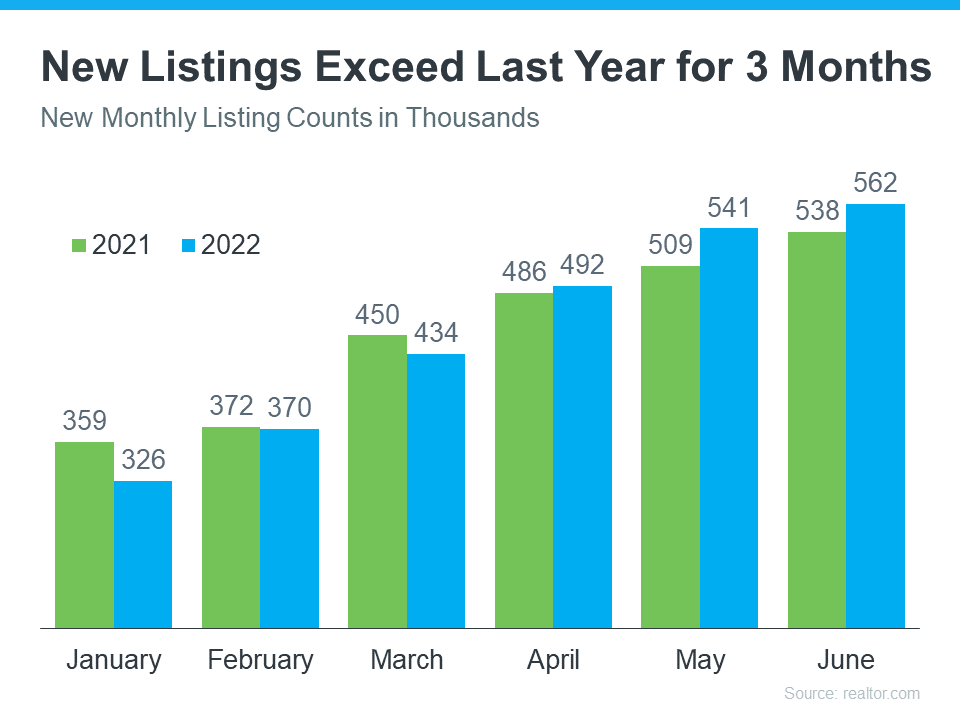

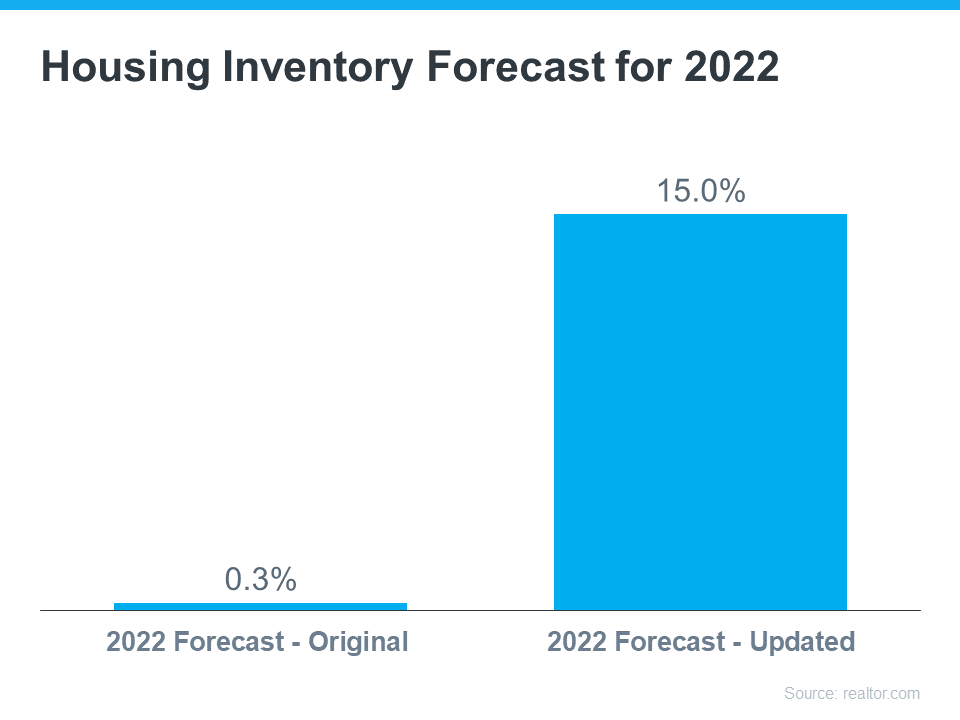

The historically low inventory over the past few years led to challenges for many buyers trying to find a home that met their needs and their budget. If you’re in the same boat, you should know the recent shift in the housing market may have opened up doors for you to restart your search.

The inventory of homes for sale has increased this year, and that’s giving buyers much needed options. As Danielle Hale, Chief Economist at realtor.com, says:

“. . . today’s shoppers have more than 5 homes to consider for every 4 they had at this time a year ago.”

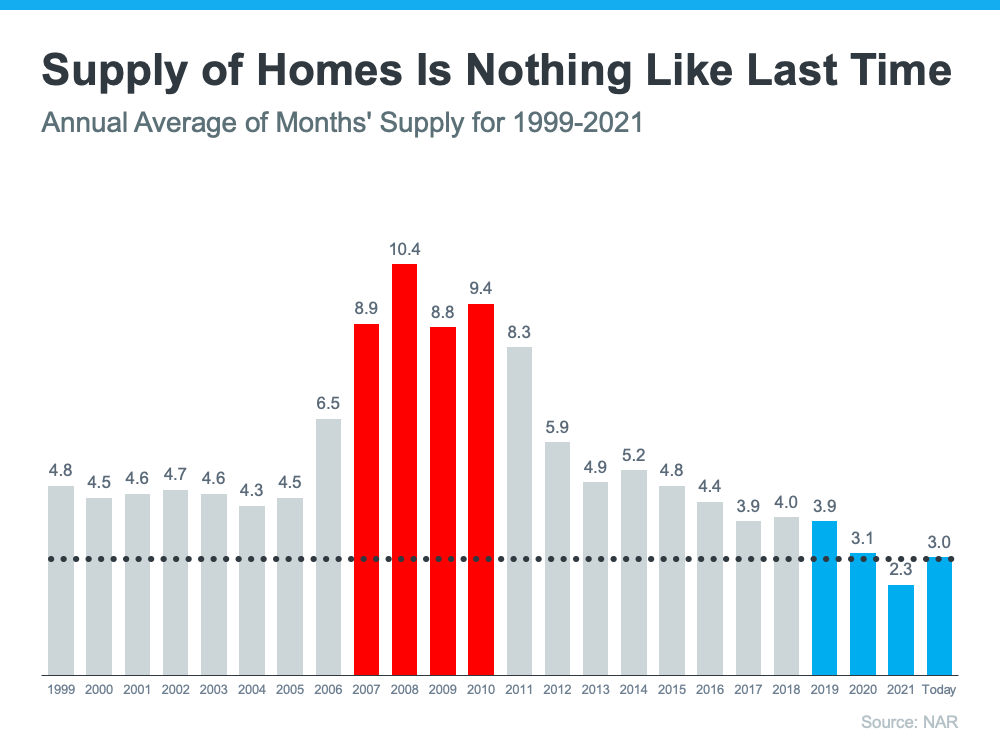

But perspective is important. Overall, housing supply is still low. If you need even more choices, expanding your search by adding additional housing types, like condominiums, could help.

Exploring Condos Could Add Options That Fit Your Budget

One thing to consider is condos generally differ from single-family homes in average space and floorplans. But that size difference is one reason why condos can be a more affordable option. According to a recent report from realtor.com, condo buyers paid roughly 7% less for their home than buyers of other housing types last year. With rising mortgage rates and home prices, the relative affordability of a condo could be worth considering.

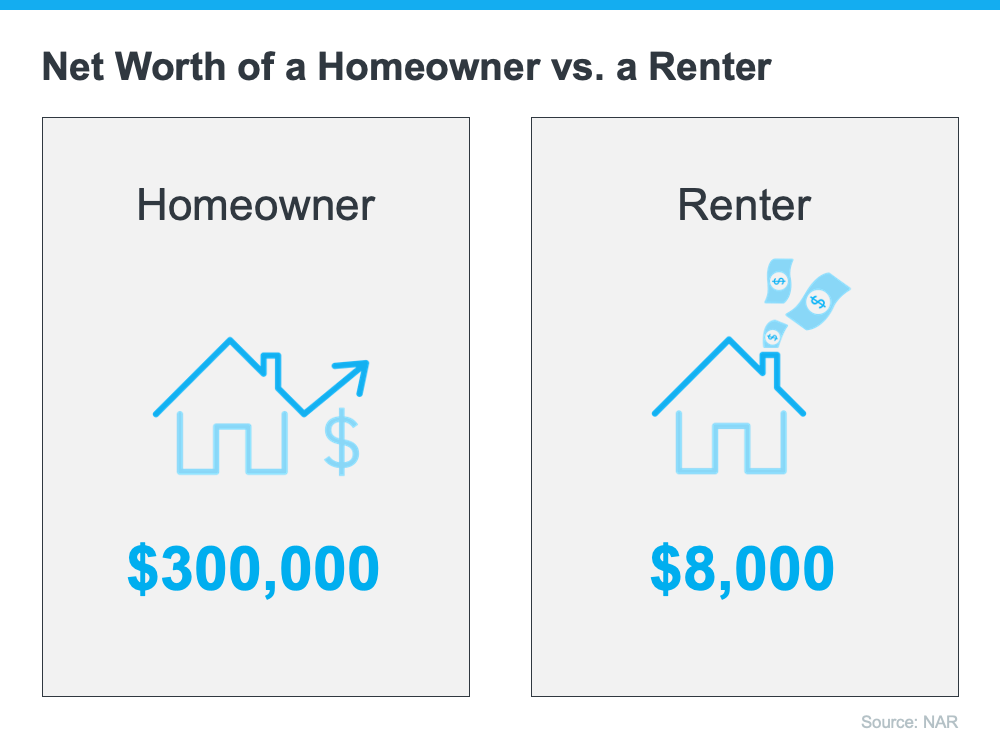

Remember, your first home doesn’t have to be your forever home. The important thing is to get your foot in the door as a homeowner. Buying a condo now can springboard you into a bigger home later on. An article from the Urban Institute explains:

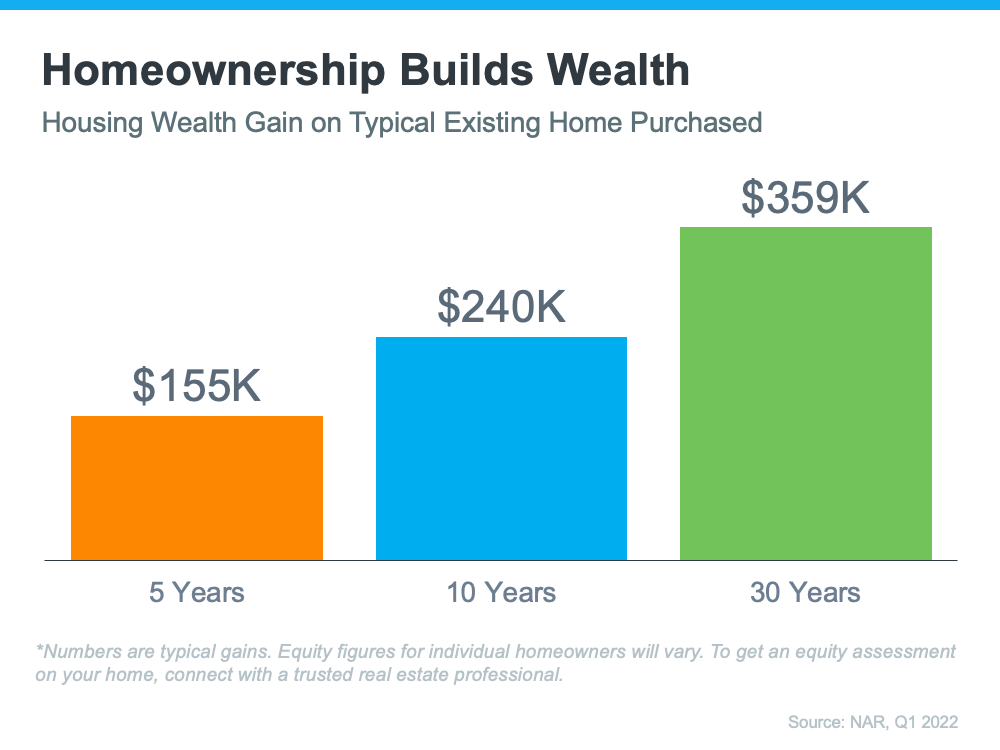

“Because condos and co-ops are generally more affordable, they tend to help first-time homebuyers step onto the first rung of the homeownership ladder. These buyers often use the equity on their condo to then purchase a larger single-family home.”

In other words, owning a condo will help you start building wealth in the form of home equity. In time, the equity you build can fuel a future purchase should you decide you want to buy a home with more space or different amenities.

Condo Living Provides Several Great Perks

Boosting the number of options in your budget during your home search is just one reason to consider condos, but there are several other benefits to condo living.

First, they tend to require minimal upkeep and lower maintenance – and that can give you more time to spend doing the things you enjoy. A recent article from Bankrate highlights this, saying:

“Condos can be a good option for anyone who wants to keep home maintenance to a minimum . . . if the roof is leaking or the carpet in the lobby needs to be replaced, that’s not your responsibility — the condo association handles those duties.”

Plus, since many condos are located in or near city centers, they offer the added benefit of being in close proximity to work and leisure. Again, realtor.com explains:

“Buying a condo, which is generally less expensive than a single-family home, enables a household to afford to own in the middle of it all, and often means a newer-built home with less maintenance responsibility.”

Ultimately, owning and living in a condo can be a lifestyle choice. And if that appeals to you, they could give you the added options you need to buy your first home.

Bottom Line

Adding condominiums to your housing search could be a great move. If you’re ready to search condos in our area, let’s connect today.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link