How Interest Rates Shape the Real Estate Market

By Charles Dizon, Century 21 Real Estate Center – October 24, 2024

Let’s dive into something that impacts everyone in real estate: interest rates. They’re a big deal, affecting everything from loan affordability to housing demand to the overall economy. For anyone buying, selling, or investing, a solid grasp on how interest rates influence the market is key. And while the Federal Reserve plays a big role by adjusting rates, it’s rarely a straightforward cause-and-effect on mortgage rates—there’s a lot more to it.

The Link Between Interest Rates and Real Estate

1. Mortgage Affordability

Interest rates directly shape what people pay on mortgages, which translates into what homes they can afford.

- Low Rates: When rates drop, monthly payments do too, so buyers can often afford higher-priced homes.

- High Rates: Higher rates mean bigger monthly payments, shrinking buyers’ purchasing power and, in some cases, the number of eligible buyers.

2. Housing Demand

Interest rates also sway the level of demand in the housing market. When rates are low, buyers can finance homes more affordably, driving up demand and often home prices. On the flip side, high rates tend to cool things off by making loans more expensive and reducing buyer activity.

3. Real Estate Investment

For investors, interest rates are a deciding factor in the cost of financing properties. Lower rates generally attract more investment in real estate, as cheaper financing boosts potential returns. But as rates rise, the cost of borrowing climbs, and investment interest may start to taper off.

4. Refinancing Frenzy

When rates drop, it’s often an invitation for homeowners to refinance. Lower rates mean smaller monthly payments and can free up cash flow. Naturally, higher rates mean fewer folks jumping on the refinance train.

The Role of the Federal Reserve

The Federal Reserve—or “the Fed”—is a key player here. By setting the federal funds rate (the rate at which banks lend to each other), the Fed can either cool off or rev up the economy. But it’s important to note that while Fed rate changes influence mortgage rates, the connection is indirect and influenced by market conditions.

- Short vs. Long-Term Rates: The Fed primarily affects short-term rates, while mortgage rates are more in line with long-term rates, which are shaped by factors like inflation expectations and demand for mortgage-backed securities.

- Market Expectations: Mortgage rates are heavily impacted by what investors anticipate for the economy. If the Fed signals a rate cut, mortgage rates might drop, provided investors expect stable inflation and economic growth.

- The Yield Curve: Fed policy changes can reshape the yield curve, impacting longer-term rates like mortgages. But again, it’s mediated by how the market reacts.

Will a Fed Rate Cut Always Lower Mortgage Rates?

Not necessarily. While a Fed rate cut often nudges mortgage rates down, it’s no guarantee. Inflation, global conditions, and investor sentiment all play a part in the outcome.

Volatility on the Horizon

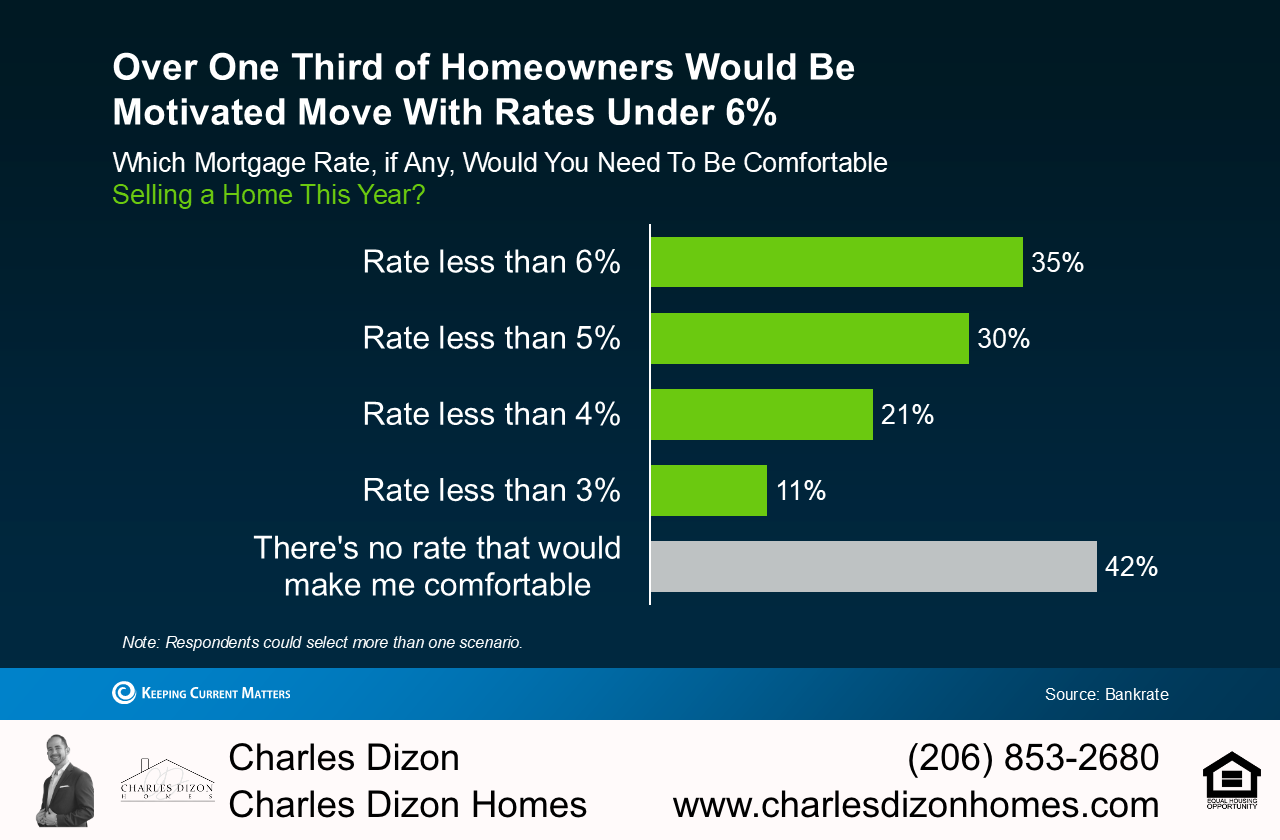

We expect some volatility in the coming months regarding interest rates, and we’re already seeing the shifts play out. In the past six weeks alone, mortgage rates have jumped from around 6.09% to nearly 6.9%. For anyone navigating the market—whether buying, selling, or investing—these changes underscore the importance of staying informed and ready to adapt.

Interest rates have a big influence on real estate, from making or breaking mortgage affordability to shaping demand and investor interest. For buyers, sellers, and investors, understanding how these rates work—and how the Fed plays into it—helps to make savvy, informed decisions. And as always, a knowledgeable real estate professional can help you navigate these waters, whatever the rate environment.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link